Recognizing GSA SmartPay® Cards/Accounts

Learn how to identify the different types of GSA SmartPay cards/accounts.

Card/Account Type

To identify cards/accounts, it is important to know whether a card/account is a Centrally Billed Account (CBA) or Individually Billed Account (IBA).

For CBAs:

- Agency is invoiced for purchases.

- Payments are made directly to the contractor banks by the federal government.

- Examples include purchase, fleet, and some travel cards/accounts.

For IBAs:

- Card/account holder is invoiced directly.

- Payment is the responsibility of the card/account holder, who is then reimbursed by the agency/organization.

- Most common travel cards/accounts.

Card/Account Prefix

The prefix is the first four digits that appear on the charge card/account.

Bank Identification Number (BIN)

The BIN is the first six digits that appear on the charge card/account.

Travel Cards/Accounts

GSA SmartPay Travel cards/accounts can be used for official government travel and travel-related expenses, while allowing card/account holders access to GSA’s City Pair Program reduced airfares.

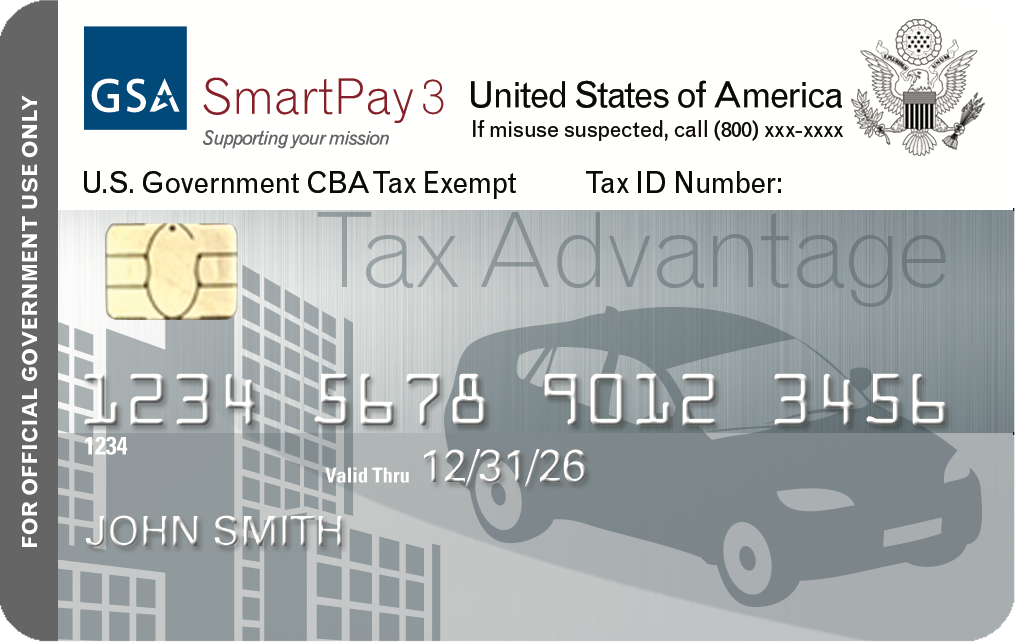

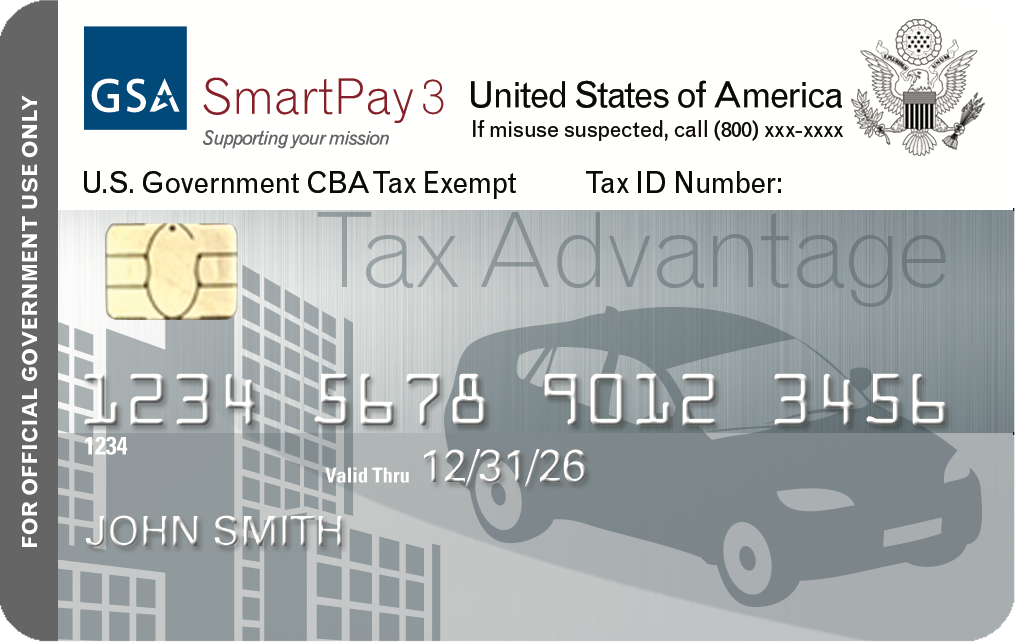

Travel Card Designs

Typically, travel cards have one of these designs:

Please note that card designs may vary.

GSA SmartPay Travel Card/Account Prefixes

| Brand | Card/Account Prefix |

|---|---|

| Mastercard | 5565, 5568 |

| Visa | 4486, 4614, 4615, 4716 |

The Sixth Digit Identifies Account Type

For the travel business line only, the sixth digit will identify whether the card/account is a CBA or IBA.

| Card/Account | Sixth Digit | Account Type |

|---|---|---|

IBA Travel Card | 1, 2, 3, 4 | IBA |

CBA Travel Card | 6, 7, 8, 9, 0 | CBA |

Tax Advantage Travel Card | 5 | IBA/CBA |

Travel Card/Account Tax Exemption Status

All CBA GSA SmartPay Travel cards/accounts should be exempt from state sales tax.

Some IBA GSA SmartPay Travel cards/accounts may be exempt from state taxes in select states.

Review state tax exemption information on the Tax Information by State page. To receive state tax exemption, forms, official business travel documentation, and/or a federal government identification may be required.

Purchase Cards/Accounts

In accordance with the Federal Acquisition Regulation (FAR), the GSA SmartPay Purchase card/account is the preferred method to purchase and pay for micro-purchases (FAR Part 13.201). For purchases above the micro-purchase threshold, the purchase card/account may be used as an ordering and payment mechanism, but not as a contracting mechanism.

Purchase Card Designs

Typically, purchase cards have this design:

Please note that card designs may vary.

GSA SmartPay Purchase Card/Account Prefixes

| Brand | Card/Account Prefix |

|---|---|

| Mastercard | 5565, 5568 |

| Visa | 4614, 4715*, 4716 |

*This 4-digit prefix is only used by the United States Postal Service (USPS) Uniform Allowance Program (UAP) through the GSA SmartPay program.

Purchase Card/Account Tax Exemption Status

All GSA SmartPay Purchase cards/accounts are CBAs and should be exempt from state sales tax.

The sixth digit identifier used to differentiate travel cards/accounts does not apply to purchase, fleet, or integrated cards/accounts.

Fleet Cards/Accounts

Use of GSA SmartPay Fleet cards/accounts enable agencies/organizations to conveniently obtain fuel and maintenance for vehicles and equipment, as well as manage tax recovery efforts and collect detailed fleet management data.

Fleet Card Designs

Typically, fleet cards have this design:

Please note that card designs may vary.

GSA SmartPay Fleet Card/Account Prefixes

| Brand | Card/Account Prefix |

|---|---|

| Mastercard | 5563**, 5565, 5568 |

| Visa | 4486, 4614 |

| Voyager® | 7088** |

| Wright Express® (WEX) | 5565, 6900**, 7071** |

**GSA SmartPay cards/accounts use these 4-digit prefixes; however, please note that these 4-digit prefixes may not be reserved for GSA SmartPay business only. Other non-GSA SmartPay customers may have cards/accounts with these 4-digit prefixes as well. For additional information on GSA SmartPay prefixes, please contact us directly at gsa_smartpay@gsa.gov.

Fleet Card/Account Tax Exemption Status

All GSA SmartPay Fleet cards/accounts are CBAs and should be exempt from state sales tax.

The sixth digit identifier used to differentiate travel cards/accounts does not apply to purchase, fleet, or integrated cards/accounts.

Integrated Cards/Accounts

The GSA SmartPay integrated account is a specialized card/account designed to combine the functions of the purchase, travel, and/or fleet business lines into one payment solution.

Integrated Card Designs

Typically, integrated cards have this design:

Please note that card designs may vary.

GSA SmartPay Integrated Card/Account Prefixes

| Brand | Card/Account Prefix |

|---|---|

| Mastercard | 5565 |

| Visa | 4614 |

Integrated Card/Account Tax Exemption Status

Most times, GSA SmartPay Integrated cards/accounts are CBAs and should be exempt from state sales tax.

The sixth digit identifier used to differentiate travel cards/accounts does not apply to purchase, fleet, or integrated cards/accounts.

Card-Not-Present Solutions

Transactions can also take place without a physical card.

Examples include:

- Declining Balance Cards.

- Ghost Cards.

- Mobile Payments.

- Single Use Accounts.

For more information on card-not-present solutions, please refer to the GSA SmartPay Strategic Payment Solutions publication.

Card-Not-Present Prefixes, BINs, and Tax Exemption Status

The prefixes, BINs, and tax exemption information detailed above for the travel, purchase, fleet, and integrated business lines also applies to card-not-present solutions.