SmartTax Vendor Guide

Printable Version [PDF, 04 pages]What is the GSA SmartPay® Program?

The GSA SmartPay program is the world’s largest commercial payment solution program, servicing more than 560 federal agencies, organizations, and Native American tribal governments. Customer agencies/organizations use purchase, travel, fleet and/or integrated payment solutions to support their missions.

Below are answers to common questions that will help you develop a better understanding of GSA SmartPay, state tax exemptions, and other issues related to doing business with the federal government.

Why Should I Accept GSA SmartPay Payment Solutions?

- GSA SmartPay solutions are the preferred payment method of the federal government.

- GSA SmartPay accounts are essential support tools for government agencies/organizations in supporting mission delivery.

- There are in excess of 3.5 million GSA SmartPay accounts, including more than 2.6 million travel accounts, more than 295,000 purchase accounts, and more than 595,000 fleet accounts.

- No government order forms to process.

- Reduced billing and collection costs.

- Facilitates electronic commerce.

- Improved cash flow: payment in one to three business days (per card industry commercial practice/acquirer terms).

What Are the Different Types of GSA SmartPay Accounts?

- Centrally Billed Account (CBA): expenses are directly paid by the federal government and should not be charged state taxes.

- Individually Billed Account (IBA): expenses are paid by the account holder and, depending on the state, may be eligible for state tax exemption.

- Tax Advantage Account: combines an IBA and CBA. Rental car and lodging expenses are billed as a CBA and should not be charged state taxes. All other expenses (e.g., meals) are billed as an IBA and may be eligible for state taxation.

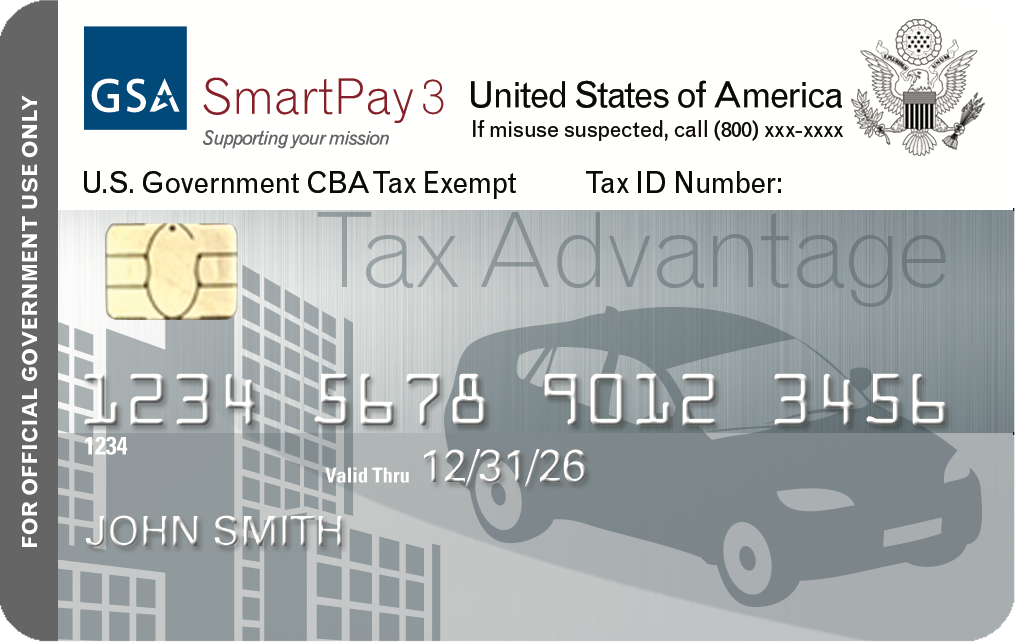

What Do the GSA SmartPay Cards Look Like?

GSA SmartPay offers both card and cardless solutions. GSA SmartPay cards, which may be either Visa® or Mastercard®, are issued by Citibank® and U.S. Bank®.

Typically, GSA SmartPay cards look like:

Purchase Card

Purchase Card

Travel Card

Travel Card

Tax Advantage Card

Tax Advantage Card

Integrated Card

Integrated Card

Fleet Card

Fleet Card

What Is a GSA SmartPay Purchase Account?

The GSA SmartPay purchase account is a procurement and/ or payment mechanism designed for the federal government to make purchases for required goods and services and payments against government contracts.

The first four digits in the bank identification numbers (BINs) on all GSA SmartPay purchase accounts include one of the following numerical combinations:

| GSA SmartPay Purchase Card | BINs |

|---|---|

| Mastercard | 5565, 5568 |

| Visa | 4614, 4715*, 4716 |

*This 4-digit prefix is only used by the United States Postal Service (USPS) Uniform Allowance Program (UAP) through the GSA SmartPay program.

Are State Taxes Charged to Purchase Accounts?

The GSA SmartPay purchase account is a CBA - meaning that the federal government makes direct payment for purchases made on the account - and thus should not be charged state taxes in most states and territories.

What Are the Best Practices for Assessing Taxes on Purchase Accounts?

- Verify that the customer is a federal employee through the card logo, the BIN, or the employee’s government ID card.

- The sixth digit of a GSA SmartPay purchase account does not need to be analyzed, because the accounts are identified by the BIN.

- If you are unsure of when to assess taxes, please visit https://smartpay.gsa.gov/smarttax/tax-information-by-state/ for more information, including points of contact for each state.

What Is a GSA SmartPay Travel Account?

The GSA SmartPay travel account is used by employees for official government travel and travel related expenses. On these accounts, the first four digits of the BINs include one of the following numerical combinations:

| GSA SmartPay Travel Card | BINs |

|---|---|

| Mastercard | 5565, 5568 |

| Visa | 4486, 4614, 4615, 4716 |

Should I Charge Taxes on GSA SmartPay Travel Accounts?

There are three types of GSA SmartPay travel accounts: CBA, IBA, and a CBA-IBA combination called a Tax Advantage Travel account.

The government makes direct payment for purchases made on the CBA travel account, and taxes should not be assessed in most states and territories.

For an IBA account, the account holder is responsible for payment and is reimbursed by the government. Taxes may or may not be assessed, depending on the state’s specific policies.

Finally, for a Tax Advantage account, the government makes direct payment for lodging and rental car purchases, and the account holder is responsible for payment on other types of transactions, such as meals and incidentals. Taxes should not be assessed on lodging and rental car purchases on the Tax Advantage Travel account.

You can determine the type of travel account by looking at the sixth digit of the account number.

| Sixth Digit of GSA SmartPay Travel Account | Account Type |

|---|---|

| 0 | CBA |

| 1 | IBA |

| 2 - 4 | IBA |

| 5 | IBA/CBA, Tax Advantage |

| 6 - 9 | CBA |

Each state determines the tax exemption status for federal travelers. Before assessing taxes, please visit https://smartpay.gsa.gov/smarttax/tax-information-by-state/. If your state exempts taxes for federal travelers, do not assess taxes!

What Should I Do When a Federal Traveler Checks In or Out of a Hotel?

- Be prepared by familiarizing yourself with your state’s tax policies and requirements.

- Know if a state tax exemption form is required for your state and be ready to provide a copy of the form to a federal traveler.

- Ask guests to verify themselves as a federal traveler when offering state tax exemption by requesting to see their government ID or travel orders. Note: It is unlawful to photocopy a government ID. For any state tax questions or concerns, please refer to the GSA SmartPay website at https://smartpay.gsa.gov/smarttax/tax-information-by-state/.

What Is a GSA SmartPay Fleet Account?

The GSA SmartPay fleet account is specifically designed for the purchase of fuel, maintenance services, and repair services of official government vehicles. The first four digits of the BINs on all GSA SmartPay fleet accounts include one of the following numerical combinations:

| GSA SmartPay Fleet Account | BINs |

|---|---|

| Mastercard | 5563**, 5565, 5568 |

| Visa | 4486, 4614 |

| Voyager® | 7088** |

| Wright Express® (WEX) | 5565, 6900**, 7071** |

**GSA SmartPay cards/accounts use these 4-digit prefixes; however, please note that these 4-digit prefixes may not be reserved for GSA SmartPay business only. Other non-GSA SmartPay customers may have cards/accounts with these 4-digit prefixes as well. For additional information on GSA SmartPay prefixes, please contact us directly at gsa_smartpay@gsa.gov.

Should I Charge Taxes on GSA SmartPay Fleet Accounts?

The GSA SmartPay fleet account is a CBA - meaning that the federal government makes direct payment for purchases made on the account - and thus should not be charged state taxes in most states and territories. For a full listing of tax exempt states, please visit the GSA SmartPay website at https://smartpay.gsa.gov/smarttax/tax-information-by-state/.

What Is a GSA SmartPay Integrated Account?

The GSA SmartPay integrated account is a specialized account designed to combine the functions of the purchase, travel, and fleet business lines into one payment solution. The first four digits of the BINs on all GSA SmartPay integrated accounts include one of the following numerical combinations:

| GSA SmartPay Integrated Account | BINs |

|---|---|

| Mastercard | 5565 |

| Visa | 4614 |

Should I Charge Taxes on Integrated Accounts?

The GSA SmartPay integrated account is a CBA - meaning that the federal government makes direct payment for purchases made on the account - and thus should not be charged state taxes in most states and territories. For a full listing of tax exempt states, please visit the GSA SmartPay website: https://smartpay.gsa.gov/smarttax/tax-information-by-state/.

How Do I Accept GSA SmartPay Accounts?

If you currently accept Visa, Mastercard, Voyager, and/or Wright Express (WEX), you are already set up to accept GSA SmartPay accounts. If your business does not currently accept charge cards, please reach out to your financial institution to discuss accepting charge cards.

What Are My Costs?

If you already accept Visa, Mastercard, Voyager, and/or WEX, there are no additional costs. The transaction fees you negotiated with your bank to accept cards from the private sector will also apply to government purchases. If you do not currently accept one or more of these cards and want to participate, the cost of acceptance is negotiated between you and your selected financial institution.

What If I Am Still Unable to Accept GSA SmartPay Accounts?

Your business may be classified under a blocked Merchant Category Code (MCC). Businesses are required to label themselves by selecting the MCC that best describes the type of product or service provided. Certain MCCs are blocked by agencies to prevent fraud and misuse of GSA SmartPay accounts. If your company is experiencing problems accepting GSA SmartPay accounts, it may be because the MCC under which your business is classified may be blocked by an agency. To remedy this problem, you can change your MCC classification to better describe the type of product or service your company provides